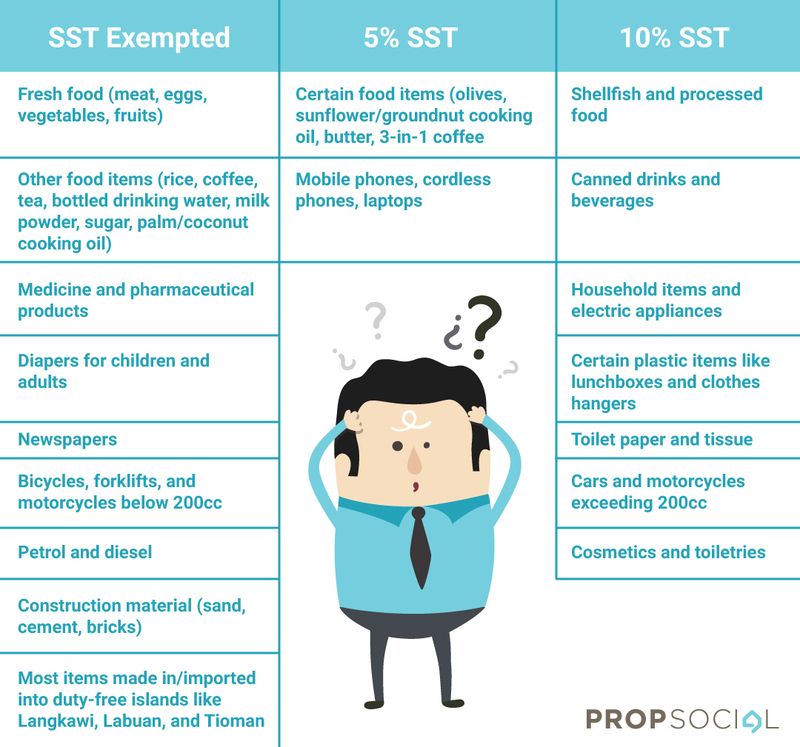

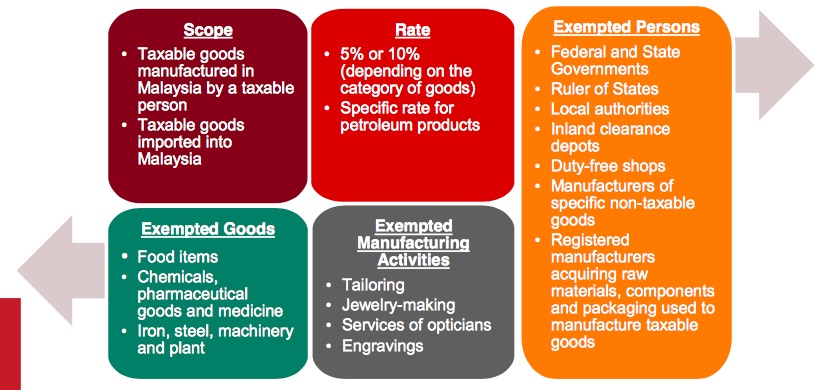

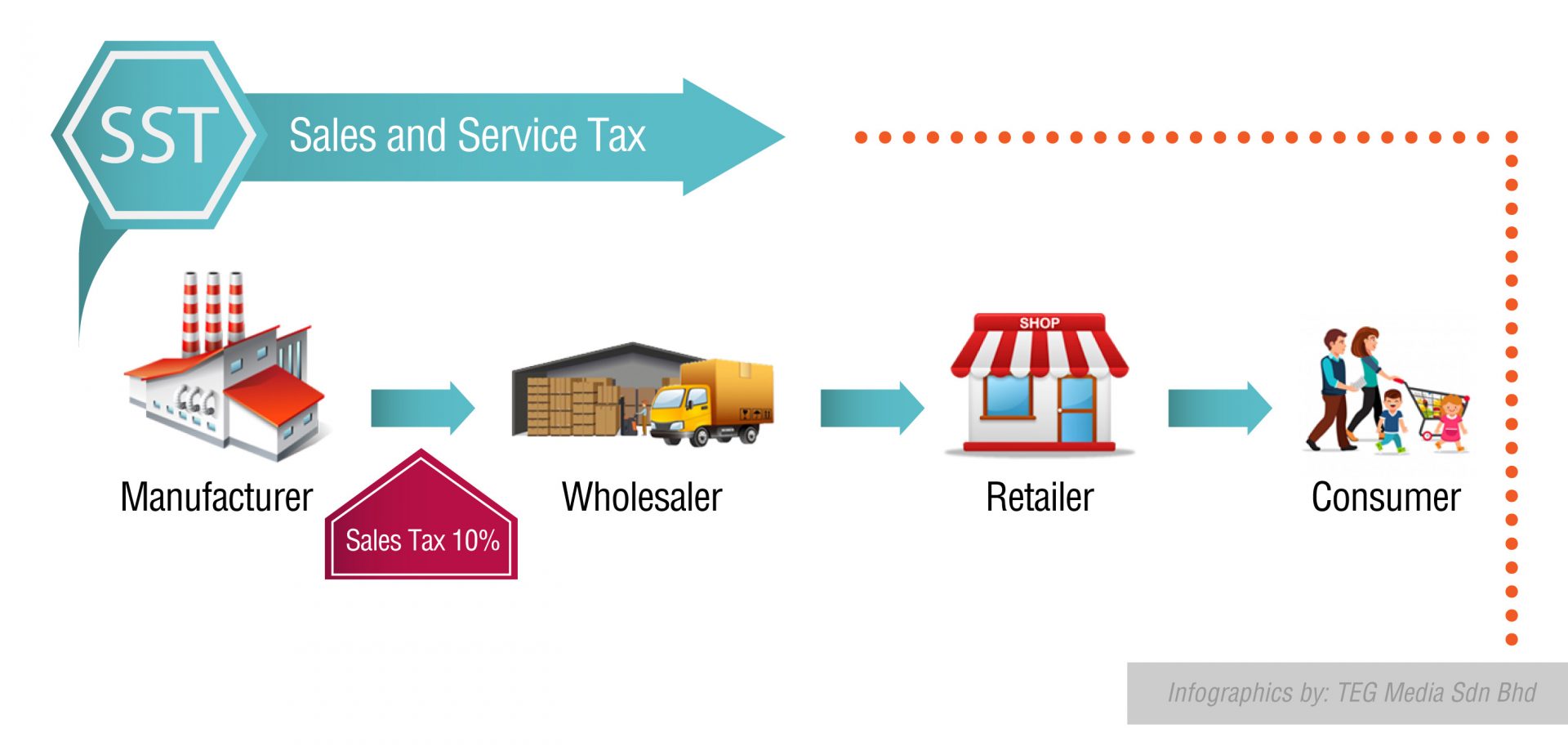

Goods are subject to a 5 to 10 sales tax while services are subject to. SCOPE CHARGE Sales tax is not charged on.

Sst Nissan Price List Cheaper By Up To Rm5 400 Paultan Org

Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya 1300 888 500 Pusat Panggilan Kastam 1800 888 855 Aduan Penyeludupan 03-8882 21002300 Ibu Pejabat.

. List Of SST Regulations. It was announced on September 1st 2018 that the Sales and Services Tax SST will be reinstated to replace the controversial Goods and Services Tax GST system GST. From 1 September 2018 the Sales and Services Tax SST will replace the Goods and Services Tax GST in Malaysia.

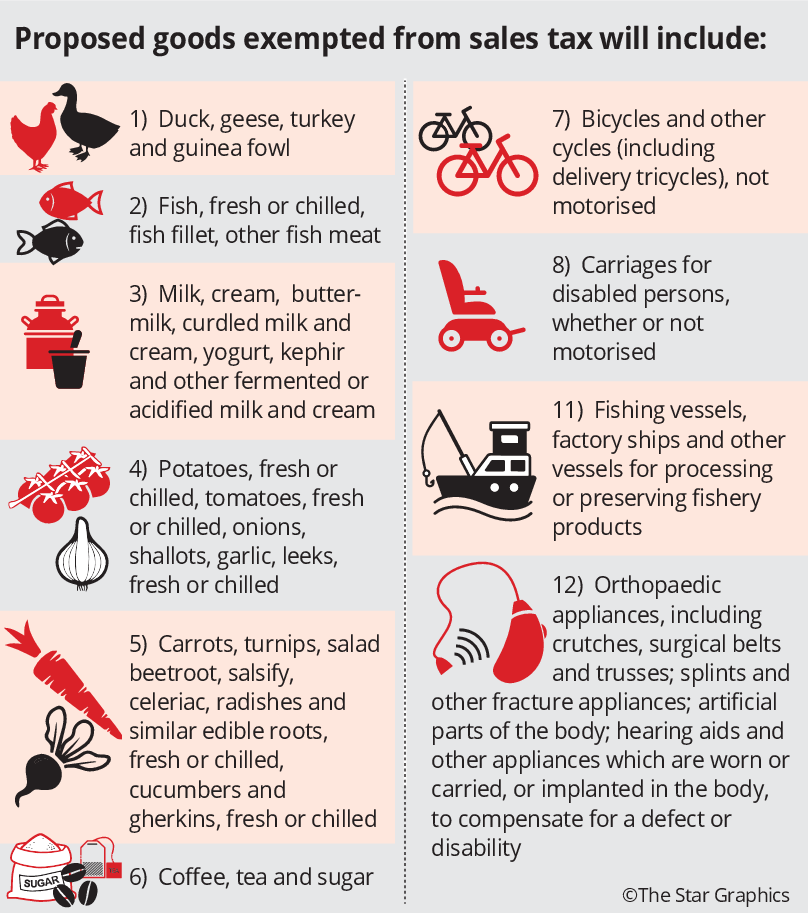

Persons exempted under Sales Tax Persons Exempted from Payment of Tax Order 2018 Goods listed under Sales Tax Goods Exempted From Tax Order 2018. Following the announcement of the re-introduction of Sales and Services Tax SST that will kick start on 1 September 2018 the Royal Malaysian Customs Department RMCD has recently announced the implementation framework of SST as well as a detailed FAQs to arm Malaysians with sufficient knowledge of the new tax regime before SST. Before the 6 GST that was implemented in 2015 Malaysia levied a Sales Tax and a Service Tax.

Here are the main amendments. It is replacing the 6 Goods and Services Tax suspended on 1 June 2018. On taxable goods manufactured in Malaysia by a taxable person and sold used or disposed by him.

Jabatan Kastam Diraja Malaysia. Companies that registered for the SST should file a report every 2 months and the first taxable period is from September to October 2018. Malaysia Sales Tax 2018.

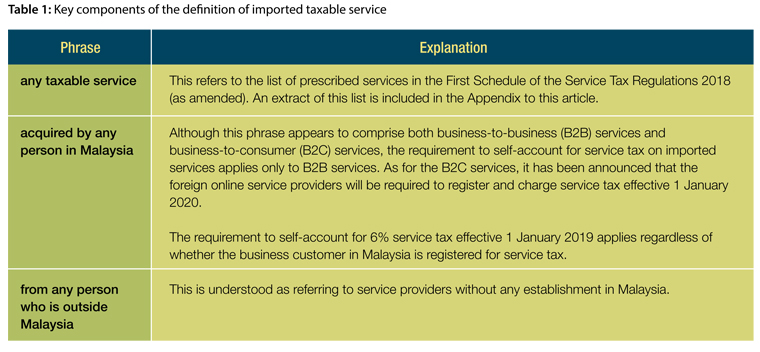

Here are the details on how the SST works - the registration process returns and payment of the SST and the transitional measures to take after the abolishment of the GST. The Service Tax rate is fixed at 6 and the list of services subject to it include hotels insurance gaming legal and accounting services employment agencies parking couriers advertising and electricity. In this regard Bursa Malaysia Berhad and some of its subsidiaries have been registered for service tax purposes and will start charging 6 service tax on certain fees effective from 1 May 2019.

The current tax rate for sales tax is 5 and 10 while the service tax rate is 6. Contact Us Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya Hotline. The move of scrapping the 6 GST has paved the way for the re-introduction of SST which will come into effect in 1 September 2018.

SST Malaysia Info Sharing of all the info about SST Malaysia that going to be implement in September 1 2018. Implemented since September 2018 Sales and Service Tax SST has replaced Goods and Services Tax GST in MalaysiaThe SST consists of 2 elements. Service tax a consumption tax levied and.

The SST-02 return should be submitted on or before the last day of the month that follows the taxable period. List of Proposed Goods Exempted From Sales Tax Person - Proposed Sales Tax Person Exempted From Sales Tax Order 2018. Sales tax a single-stage tax imposed on taxable goods manufactured locally and sold by a registered manufacturer and on taxable goods imported into Malaysia.

Sales Tax Regulations Sales Tax Regulations 2018. If your company is already GST-registered the MySST system will automatically register your company for SST. Customs SST Malaysia.

ORDER 2018 which came into effect on 1 Sept 2018 is a list of persons who are exempted from payment of Sales Tax. Sales Tax Act 2018 Regulations Sales Tax Regulations 2018 Sales Tax Customs Ruling Regulations 2018. A manufactured in Malaysia by a registered manufacturer and sold used or disposed of by him.

On the SST Lim said Malaysias 2018 Sales and Services Tax SST collection by the Royal Malaysia Customs Department amounted to RM54 billion which is some 34 higher than the RM4 billion target set during the SSTs implementation on September 1 2018. Or b imported into Malaysia by any person. Amendment 12019 Sales Tax Determination Of Sale Value Of Taxable Goods Regulations 2018.

Effective 1 September 2018 the Malaysian Government has replaced the Goods and Services Tax GST with Sales and Service Tax SST. The Malaysia Service Tax Amendment Regulations for 2019. The Sales Tax is a single-stage tax charged and levied on taxable goods imported into Malaysia and on taxable goods manufactured in Malaysia by a taxable person and sold by him including used or disposed of goods.

He said the 2018 SST collection was higher than estimated due to the governments effort. Malaysia has tabled at Parliament the implementation bill for its Sales and Service Tax SST which comes into force on 1 September 2018. The Sales Tax is levied at the import or manufacturing levels and companies with a sales value of taxable goods exceeding RM500000.

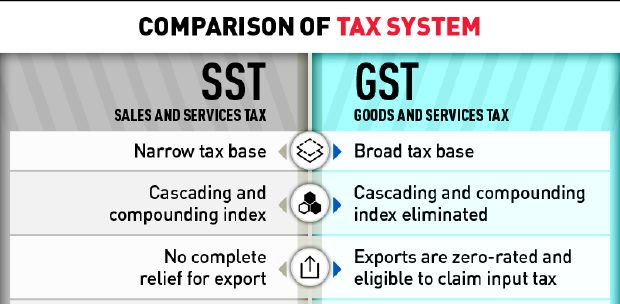

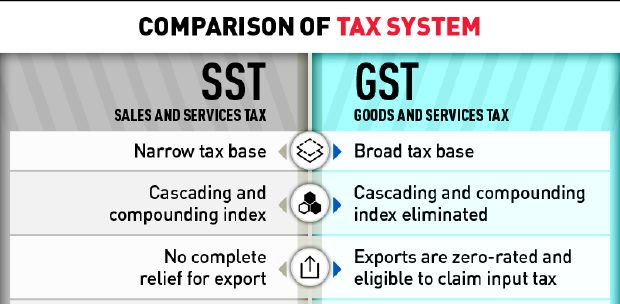

I The SST will be a single-stage tax where the sales ad. SST in Malaysia was introduced to replace GST in 2018. Service Tax Regulations Service Tax Regulations 2018.

The exemption is not automatic but is subject to the person complying with conditions specified in column 4 of Schedule A Schedule B and Schedule C whichever is relevant to him. For advice on SST do not hesitate to contact Acclime. In Malaysia it is a mandatory requirement that all manufacturers of taxable goods are licensed under the Sales Tax Act 2018.

MALAYSIAs decision to revert to the Sales and Service Tax SST from the Goods and Services Tax GST will result in a higher disposable income due to relatively lower prices it will incur in. The switch is expected to cost the country an estimated at RM25 billion in lost revenues as only a fraction of the companies. The Ministry of Finance MoF announced that Sales and Service Tax SST will come into effect in Malaysia on 1 September 2018.

Sst Simplified Malaysian Sales Tax Guide Mypf My

Goods And Person Exempted From Sales Tax Sst Malaysia

Post Sst Volkswagen Malaysia Reduce Prices For Ckd Models Autobuzz My

![]()

Mercedes Benz Malaysia Announces New Sst Price List While Glc Gets Safety Updates

Sst Malaysia 2018 List Gabrieltrf

Welcome Back Sst So What S New Propsocial

Gst Better Than Sst Say Experts

The Differences Between Sst And Gst Aesoft Technology Solutions Selangor Malaysia Newpages

Malaysia Proposed Sales And Service Tax Sst Implementation Framework Conventus Law

Sst Vs Gst How Do They Work Expatgo

Motoring Malaysia Sst Prices For Bmw Cars Motorrad Mini In Malaysia Have Been Released Ckd Prices Mostly Goes Down With Cbu Prices Mostly Up

Essential Items Will Be Exempted From Sst

Malaysia Sst Sales And Service Tax A Complete Guide

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

How Is Malaysia Sst Different From Gst

The Differences Between Sst And Gst Aesoft Technology Solutions Selangor Malaysia Newpages

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Motoring Malaysia Mercedes Benz Malaysia Announces New Sst Pricelists Product Upgrades Namely The Glc 200 Glc 250 And New Night Edition Variants For The Gla 200 Cla 200

Procuring Service From Foreign Providers Here S An Additional 6 Tax Accountants Today